Affiliate programs and gambling have gone hand in hand for at least the last 20 years– mostly out of necessity due to the vertical being essentially untouchable by traditional ad networks (not to mention payment processors). Casinos offer 3rd party affiliates huge bonuses for signups and/or lifetime commissions based on a user’s deposits and losses, because why not? The margins of online gaming (and SaaS businesses, as I’ll probably discuss in another post) are absolutely insane, especially relative to their B&M counterparts, so there is way more leeway in having a higher SG&A budget. The problem arises as essentially the principle-agent relationship– the affiliate may not be presenting the best offers to the consumer, as the best offers may not be the most lucrative for the affiliate’s earnings.

Search Engines

Google is one of the world’s largest advertising companies in the world. They happen to run a search engine. Their core product involves showing advertisements to consumers who are actively searching for a specific product or service. They provide “free” organic results, albeit placed below the ever growing assortment of paid results. Google has lost various different antitrust suits both in the US and EU. Combine this with statistics such as 42% of people saying Google search is becoming less useful, and you can begin to ask yourself “why would Google show useful results for free, when they can make more money by forcing more businesses to pay for visibility?” This is at the core of the affiliate-consumer relationship. The affiliate (or publisher, ad network, etc.) will typically end up only including or promoting the results or deals that are most favorable to their own bottom line.

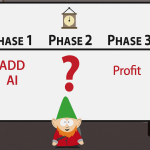

The Lifecycle of “Consumer Oriented” Companies (e.g. enshittification)

The Points Guy – This travel oriented site started out great. A site focused on how to maximize credit card rewards. The founder focused on the actual best deals for travel, and monetized via affiliate commissions– albeit naturally. Within 2 years the site was profitable enough to be sold to Bankrate and eventually Red Ventures, a digital performance marketing company. The focus now is primarily shilling whichever credit card has the highest conversion rate and commission rate for the site’s owners, even if they aren’t the best for consumers in terms of rates, sign up bonuses, annual fees, rewards rates, etc..

Yelp – Everyone knows Yelp. They are focused on restaurant and B2C reviews and were initially a trusted, objective source (see: consensus/including all reviews) for included businesses. Their ardent reviewers have even been parodied on South Park. They have even sued Google over their anti-competitive behaviors. Yelp themselves, though, have evolved into extortion artists. Just like TrustPilot, GlassDoor and The BBB, if you pay, you get to moderate the reviews, to a degree. Yelp is much more aggressive and employ large sales forces who preemptively hide reviews, then reach out to businesses offering subscription packages. Lots of fun and angry threads on 3rd party social media to see business’ views of Yelp’s practices.

OddsJam – Five paragraphs in before the agenda of this post comes to fruition. OddsJam has been the defacto arbitrage platform for sports bettors wanting to have a positive ROI over the past 2-3 years. They have focused on building an odds ingestion and display platform marketed towards both consumers as OddsJam and businesses via OpticOdds. Gambling.com Group acquires OddsJam for $80-160 million. As Gambling.com Group has relationships with essentially every US and EU casino company, there isn’t an immediately obvious conclusion to jump to. Do they start promoting different sports books based on quotas or whichever has the most favorable terms for themselves as affiliates? If they behave similarly to sites in the credit card, insurance or home service spaces, they will conform to their advertiser’s preferences. If OddsJam driven account signup referrals are actually costing sportsbooks money by being winners, would the sportsbook want to continue doing business with OddsJam?

The Takeaways

The inaugural post on Oddize’s Backstretch Blog hopefully doesn’t come away as just trashing a potential competitor, rather speculating on incentives. Since OddsJam’s acquisition, at least half a dozen new odds board clone sites have popped up on Reddit alone. There isn’t anything inherently special about an odds shopping aggregation site. When building Oddize, one of the potential monetization methods considered was sportsbook referrals, and it is tempting to go the easy route. Offer the product for free, but then the consumer ends up being the product to be monetized. The goal of Oddize is to educate and inform bettors, a byproduct of which may be antagonistic towards sportsbooks, who themselves can tend to be kind of predatory, which will be the topic of another blog post.