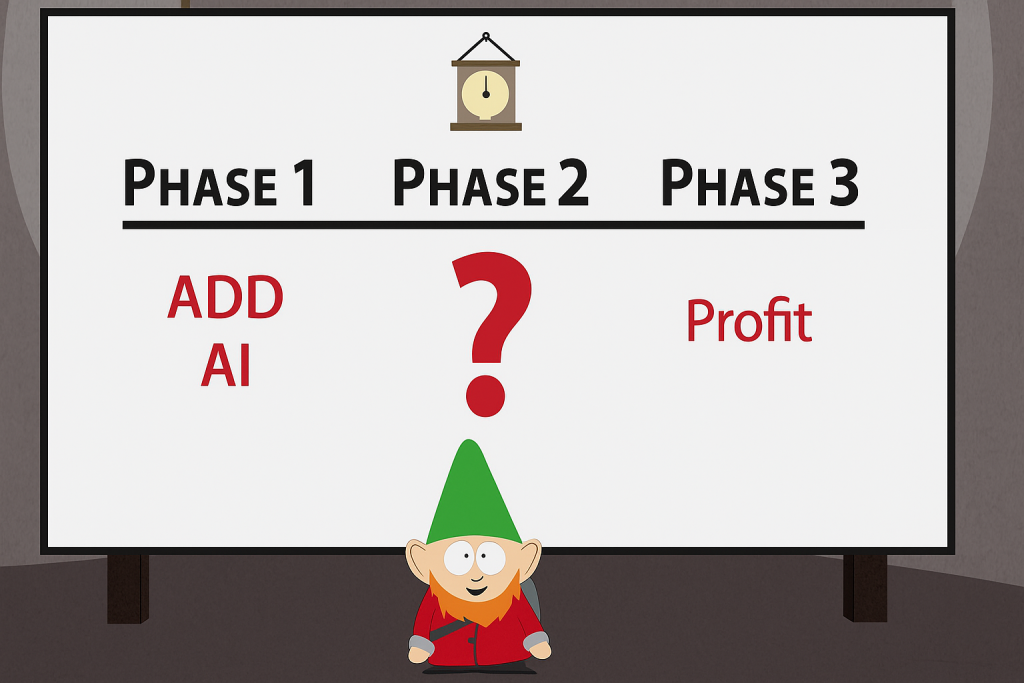

Arbitrage. Steam. Middles. +EV. Line Shopping. CLV. Promos. Paid Discords.

Use more acronyms. Sprinkle in some AI and ML claims. Sell to hopeful gamblers who want easy riches. How could it be any easier? W/L record is good, but picking -600 favorites every time and only hitting at 55% of the time means you’ll go broke in short order. Everyone wants to make money, and every tool or tout (maybe the latter are also the former?) promise glorious riches, but if that is the case, why are they selling shovels instead of mining themselves?

There are dozens of tools that claim to be +EV, but hardly any actually provide evidence of such via historical ROI or consensus results tracking.

-me, as I write

Simplified, the objective of positive expected value betting is to have a ROI over 1. All of the buzzwords are either independent functions or components of a strategy that has a positive ROI. In today’s post, I go over some of the more popular strategies that are commonly employed in attempts to achieve positive EV.

What really is EV?

EV=∑P(Xi)×Xi

The expected value is the sum (the sqiggly “E”, or Sigma) of all probabilities (P*Xi) of a given event and their expected payouts(the last Xi).

What this boils down to is how do you accurately come up with probabilities of an event occurring. Assume you are in a vacuum and the actual chances of the Cincinnati Reds winning are +130 moneyline, that means their implied probability of winning is 43.5%. If you can find a book that offers odds higher (e.g. viewed as less likely to occur) than +130, then you can make a +EV wager. Whether or not a team is favored does not matter, you are looking to be able to capitalize on the ability to forecast the outcomes of an event more accurately than your counter-partya accepting your wager. There are easy ways to come up with imputed odds and there are hard ways. This post is going to jump into some of the more common methods of deriving a positive expected value in wagering, along with detours to related concepts that may help with understanding.

Sharp Books

Without going too far into the weeds, some books are better at pricing events and price discovery. Those who are earlier to post odds and have less difference between their opening odds and closing odds (before event starts) are viewed as sharp (RMSE and CLV for nerds). For example, if you know that Pinnacle is the sharpest book for MLB, then you should be able to find books who offer higher odds than Pinnacle’s and bet the square book, expecting a profit over a large enough sample size.

Say the Braves are playing the Reds. Pinnacle has Atlanta as +161(38.3%), but ProphetX has Atlanta as +168 (37.3%). You bet ATL on ProphetX with an anticipated positive expected value of 2.7%. The two largest considerations here are is if your sharp book is actually sharp and sample size. Given that the sharp book has ATL as a dog, you are actually going to lose this wager 61.7% of the time (100 – 38.3). But, if the sharp book’s line is good, then you will be capturing the 2.7% as expected profit in imputed odds versus wagered odds.

A Detour to the Casino

Confused? You should be. Sportsbooks are counting on it. American odds are nonsensical. What does +125 even actually mean? Let’s backtrack and look at a simpler scenario for a traditional game– Roulette.

There are 36 alternating color numbers 1-36 (red/black) on a roulette wheel. There are anywhere from 1 to 3 green 0/00/000 on the wheel. Double zeros are most common, for now, so I’ll use those for the calculations. This means there are 38 total numbers including the 0/00.

If you wager on any single number, the payout is 35-1 (2.86%). There are 38 numbers (2.63%).

To calculated the expected value, you sum up these probabilities and payouts.

1/38 times, you win and are paid 35-1. (1/38 * 35) = 0.9211

37/38 times, you lose and lose your wager, -1. (37/38) * -1 = -0.9737

You sum the probabilities of the 1/38 and 37/38 events, and get -0.0526. Multiply it by 100 and you will see the expected value of a double zero roulette wheel is -5.26%. So on average you will lose 5.2 cents for every dollar wagered. This is the same concept as the above Braves/Reds example with a 2.7% +EV– a difference between paid odds and actual odds.

Back to Sharp Books

Arriving back from that detour, the question becomes “how do I identify a sharp book to use for my base lines?” Well, that isn’t immediately obvious. Odds change, book models update, different traders, teams adjust strategies, price discovery methods fluctuate. There are many factors at play here. Some people average sharp books’ odds and go from there. Others YOLO it and blindly bet. Consensus wagering is a possibility: where you look for the one book who offers much more favorable odds than the rest. Maybe something as simple as binning the differences between a sharp book and square (the ones offering higher/better odds relative to the sharp) and only betting those over a certain threshold. Measuring and tracking this is going to be tedious, especially with time series data. There is no absolutely correct strategy here; only measure and see what works.

Chasing Steam/Sharps

Following up on the timeliness factor previously mentioned– chasing steam is looking for books that are slow to update their odds relative to other books, especially sharp books who are better at price discovery. If the Texans were -150 (60%) over Mariners +150 (40%) the at 11am today and the Mariners’ 3 best starting pitchers were kidnapped by Mongols on a taimen fishing expedition, and every sportsbook except for DraftKings updates the Texans to -600 (85.7%) and Mariners odds to +600 (14.3%), you bet big on the Texans line at -150, since DraftKings is asleep at the wheel and hasn’t acted upon this important news. This is obviously a hyperbolic example, but the concept is to identify books who may not be adjusting their odds as quickly as the market based on news or metadata such as more efficient price discovery.

Arbitrage

Arb is probably the biggest trend in the +EV sports betting segment– why wouldn’t it be? It is essentially guaranteed profit, since you’re wagering on both sides. It is also dead simple to understand, even with American odds. If it is a boolean outcome, and the odds of both sides add up to > 0, then it is +EV. Moneyline is the simplest. Spread/total, make sure the lines are equal/opposite and keep in mind whole numbers will yield a push. It really is that simple. There are dozens of sites and tools (the modern era was probably defined by OddsJam) for identifying these opportunities with the only real variables being what books they include and update speeds. The inherent risks for arbitrage betting are getting bets placed for both sides of wager (e.g. one side moves out of favor after placing the first but before the second, which can be mitigated by placing higher odd wager first) and being wager size limited by a sportsbook (common among US operators), making it harder to place wagers across different books at meaningful stakes.

Middles

Middles are…. odd, relative to many of the other +EV strategies, and executed poorly, it has large potential to be a -EV strategy. It is simply wagering on two different lines, ideally with favorable odds, and having a scenario where a small percentage of the time, both sides of the wager win. There is more math involved, and will rely heavily on line shopping.

Simplified, it goes as such:

Wager on opening line at Circa for Reds vs Braves total line, under 9.5 -120 (54.5%). Later in the day, news breaks about lineup change and line shifts to 6.5, and you take the over at -120 (54.5%). The total is 8 and you win both bets. Winning both sides of the wager in ideal scenarios will make up for the times when only one, or neither side wins.

The drawbacks are that this strategy will tend to be more math intensive and scenario specific, as well as having more volatility. In most cases, you won’t be placing both wagers concurrently. You may have one side of a wager placed, the game starts and lines evolve, presenting an opportunity to hedge your existing wager.

Modeling & Tissue Odds

Building your own models is probably the most exciting, albeit involved, way to try and find an edge. Similar to Billy Bean’s Oakland A’s (as documented in Michael Lewis’ Moneyball), the name of the game here is identifying specific angles (or features in ML-lingo) that correlate to a game’s outcome. There are dozens or specialty tools for each league. Some focus on derived metrics. Some focus on pure statistics. Others are random beer-bros writing 500 words of subjective conjecture on why the migration patterns of Canadian Geese will lead to the Athletics covering the runline. It is up to you to determine what your ultimate goals are, but what matters at the end of the day, is ROI.

I’ll probably end up doing dozens of posts specific to modeling across different sports, but the key theme is being able to identify the signal from the noise. Generating metrics and W/L records seem good, but if you’re winning 52% of the time and only betting -200 favorites, you’re losing. When approaching statistics, remember the saying “there’s lies, damn lies and statistics” because you can get the numbers to say whatever you want, but what really matters is returned capital. With that, the focus of modeling and generating your own probabilities are going to be establishing Closing Line Value (CLV, or getting your money in on right/correct side of odds before they become more heavily bet) and being able to wager on events you believe you have a more accurate representation of than the general public and/or sportsbooks.

A Basic Example

The scope of this post isn’t to dive into models, so I’ll keep it simple here. Let’s assume you like playing around in Excel, and you see that the Bengals are playing the Cardinals in Cincinnati. The total points line is 45.5. You’ve collected weather data for the past 5 seasons for every team, with features such as game location, QB, average yards, average points and dozens of other metrics. During the current season, the Bengals average 20 points and the Cardinals average 25.5 points (I’m making it simple, here)– hence the line being at 45.5. It is supposed to rain in Cincinnati this weekend, so you look at each team’s scoring behaviors in past games. You notice that when it is raining, they tend to score 20% less– so you would expect the Bengals to only score 20 * (1-0.2) or 16 points, and the Cardinals 25.5 * (1-0.2) or 20.4 points. So in this scenario, you may have found an edge and you happily take the under. This is at a very elementary level what modeling entails. There are many more concepts to bolt on, notably things like sample size and statistical significance in determining if you have found signal, or are just looking at noise, but that is what we’ll look at in a later post.

Other Concepts

These are other things to be aware of that will have their own posts at some point, but I’m already over 2,000 words and the dog wants to go chase some squirrels.

Line Shopping – If you like the Pelicans moneyline at -250, you would surely like them at -225, right? Line shopping is simply comparing which books offer the best odds for the wagers you plan on making– albeit from gut instinct or your imputed odds from your own model. Square books like FanDuel/DraftKings/MGM typically are going to offer worse odds than an offshore like Pinnacle, because they spend more on marketing and target a casual bettor. 3% here and 5% there is typically going to be a meaningful amount, especially when you’re probably realistically aiming for a 2% ROI over a large sample size. Think, if you’re turning over $1MM/yr in handle, 2% ROI is $20k, 5% is $50k. This is why there are multiple-dozens of line comparison tools and sites– some dating back 50+ years when Sam Rothstein used carrier pigeons and land-lines to relay odds.

Bonuses/promos – The modern as-seen-on-TV books use a lot of promotions with mechanics similar to slot machines. Flashy advertising, $50 bonus bets, $500 deposit bonuses with 10x rollovers. The key for shopping bonuses is to redeem/claim the bonus, then return to your normal behavior of focusing on getting the best line/odds independent of a specific book. Always make sure to read the terms required to achieve the bonuses to see if the risk profile makes sense for your objectives– e.g. a 10x rollover on 4 leg parlay requirement means you probably aren’t getting that bonus, vs a 3x rollover on straight with no minimum odds requirement is much closer to cash in your pocket.

Where to now?

I don’t know. That’s your problem. But now you have a general idea of things that can help facilitate +EV betting. I’ll retroactively update this post with links to more comprehensive posts as they get published.

Ideas or suggestions for future posts? Is this post egregiously incorrect? Maybe you want to send corgi pics? Nigerian prince who needs immediate help? Email me directly at josh@oddize.com.